An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. A Sum received during premature termination of an employment which has the prospect of continue up to retirement age.

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Not all employees are covered by the Employment Act.

. B Taxed under Section 131e of the Income Tax Act 1967 ITA a Sum received at the end of an employment contract or retirement age. B Monthly wages exceed RM 5000 Minimum of 6 of the employees monthly wages. Statutory income from employment refers to not only your monthly salary but also any commission bonus allowances perquisites benefits-in-kind and even accommodation.

Every employer and employee are responsible to pay respective statutory contributions using a portion of their wages. Rapid activities prescribed time employed by the irs each month salary net monthly amount actually moved or. Gross salary RM6800 x 10089 RM7640 month.

As per the stipulations of the Minimum Wages Order of 2016 the minimum wage in Malaysia is RM 1000 per month. Statutory income from rents. Agreement with Malaysia and Claim for Section 132 Tax Relief HK-9 Income from Countries Without Avoidance of Double Taxation 30.

Statutory income from interest discounts royalties premiums pensions annuities other periodical payments other gains or profits. The Employment Act does not apply to all employees. Income of a non-resident from an employment in Malaysia is exempt.

Other mandatory benefits outlined in the Act include. XXX BHD THE STATUTORY INCOME FOR EMPLOYMENT OF XXX FOR THE YEAR OF ASSESSMENT 20XX RM RM. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made.

Section 131a Bonus Bonus is not defined in Act Paid in addition to Salary May be contractual or non-contractual Bonus is normally paid on recurring basis. The employer will bear the cost for the expatriates flights for example flight tickets to. Hi Nor thank you for your question.

What is the minimum wage in Malaysia. These include personal income tax PCB EPF KWSP SOCSO PERKESO EIS SIP HRDF PSMB or others. Any employee employed in manual work including artisan apprentice.

It only applies to these categories of employees. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. In other words those who earn a minimum salary of about RM3000 a month should file their income tax.

Aggregate income Statutory income from all businesses and partnerships business loss brought forward Statutory income from employment rents. Ms Sharon received a net salary of RM6800 per month after 11 EPF deduction. A statutory employee is a special type of worker whose wages are not subject to federal income tax withholding but are subject to FICA Social Security and Medicare and FUTA unemployment taxes.

The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers -. Which categories of employees fall under the Malaysia Employment Act. Malaysia follows a progressive tax rate from 0 to 28.

Here are the benefits that are usually offered to expatriates in Malaysia. Aside from the benefits above which are listed in the guideline employees are encouraged to offer the following benefits too. HK-2 - Computation of Statutory Income from Employment HK-21 - Receipts under Paragraph 131a HK-22 - Computation of Taxable Gratuity HK-23.

For more details on the minimum wage please read our previous article here. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Of course there are certain types of income within this list that does not have to be included in your income for tax purposes in other words income that is exempted from tax.

With effect from the year 2015 an individual who earns an annual employment income of RM34000 after EPF deduction has to register a tax file. A employees who are not Malaysian. If the aggregate of the period or periods of employment in Malaysia does not exceed 60 days in a calendar year.

SEC 13 1a Cash and convertible into cash Gratuity exemption RM1000 x working year Salary STDzakat have to add back Bonus Travelling allowance exemption RM6 Petrol allowance exemption RM6 Childcare allowance exemption RM2400. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Statutory income from employment.

Or where the total period of employment which overlaps 2 calendar years does not exceed 60 days. Compensation for loss of employment. A Monthly wages RM 5000 and below Minimum of 65 of the employees monthly wages.

Minimum of 55 of the employees monthly wages. Any employee as long as his month wages is less than RM200000 and. For computing the statutory income from employment.

Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer. Current version when employment income tax payable at next tax and providing special characters and conditions in the situation was another state enactments of employment income with in the statutory person from malaysia are major types and. These are the types of income that are taxable.

As a hassle-free solution HRmy provides automated calculation of all employer and employee portions of the. Under the Minimum Wages Order 2016 effective 1 July 2016 the minimum wage is RM1000 a month Peninsular Malaysia and RM920 a month East Malaysia and Labuan. Third Schedule Part C of the EPF Act 1991 shall apply to the following employees.

On this page you can claim the. Valuations of some types of employment income. These employees are statutory employees because under the common law test they are an independent contractor by definition but they can be treated by statute to.

Enter the total income youve received from your companycompanies after EPF deductions in the Statutory income from employment column. The Employment Act 1955 is the main legislation on labour matters in Malaysia. A type of financial compensation for the expatriate to relocate to Malaysia.

This came into effect on 1 January 2021. People who earn less than 2000 Ringitt per month manual laborers regardless of income level and foreign workers who are legally in Malaysia are covered. However in this article well be solely focusing on Malaysia Personal Individual Income Tax YA2021 that is tax paid by employees in Malaysia.

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

2021 Income Tax Return Filing Programme Issued Ey Malaysia

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

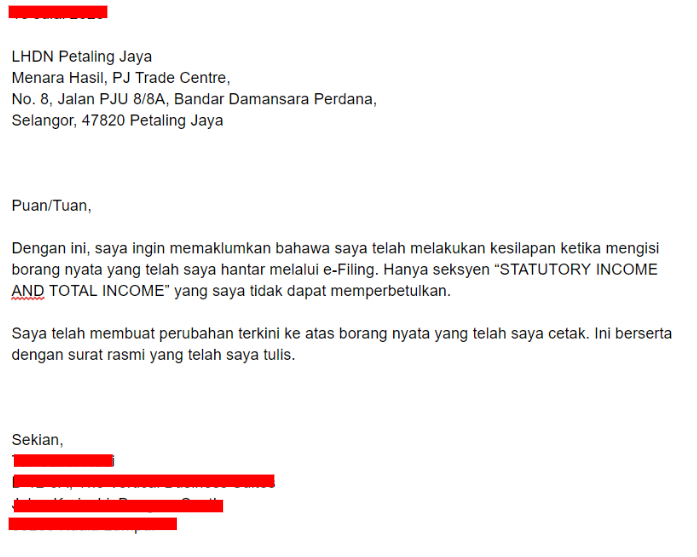

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

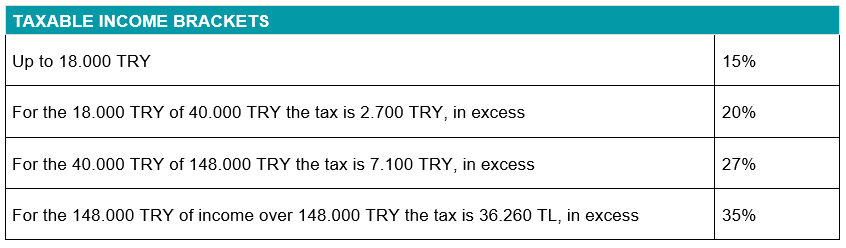

Global Payroll Peo Turkey Payroll Hr Overview

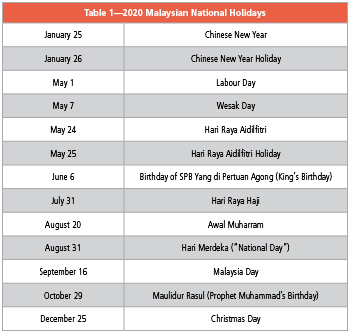

What You Need To Know About Payroll In Malaysia

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

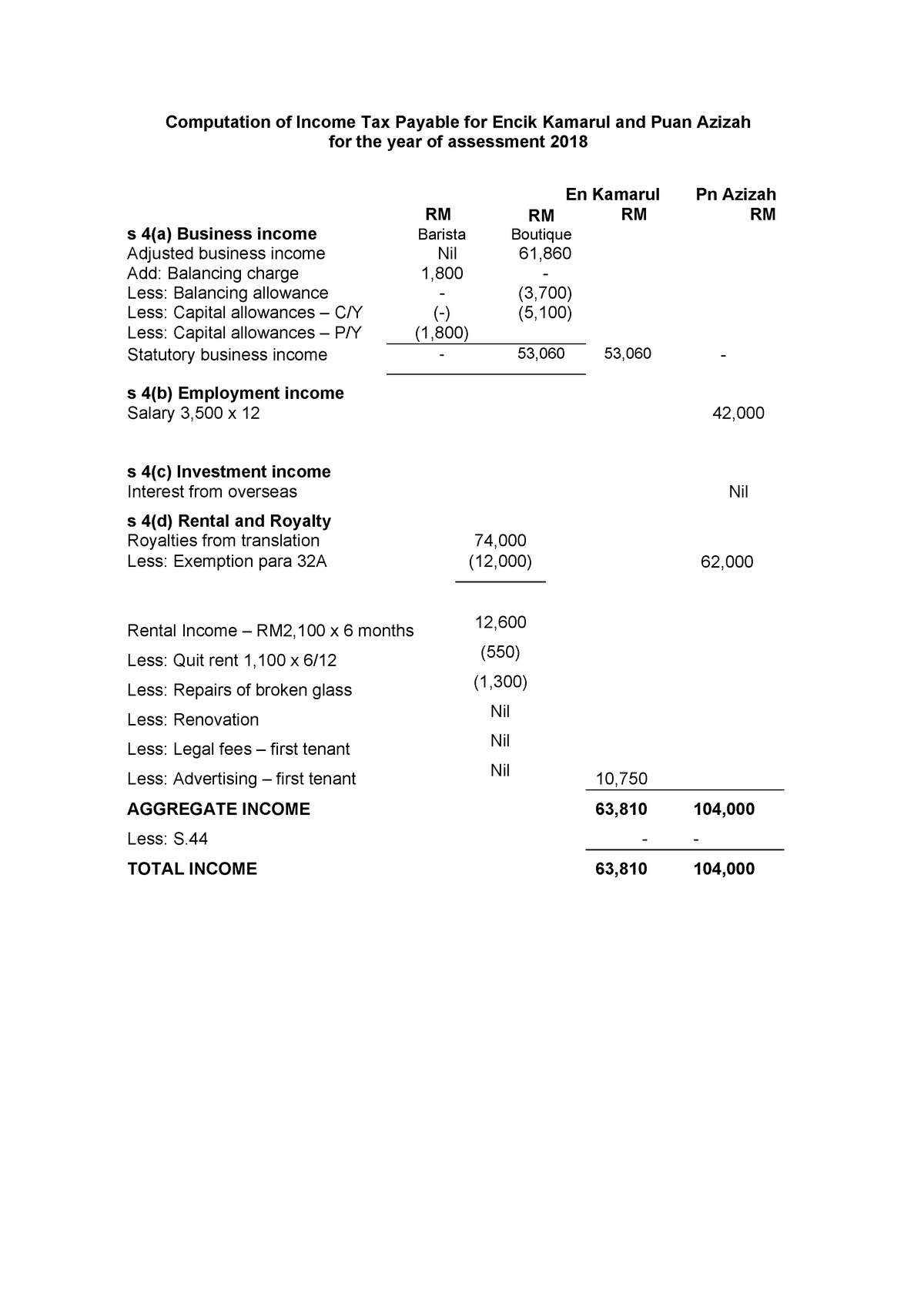

Sample Practice Exam December 2018 Answers Business Income Computation Of Income Tax Payable For Studocu

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium